Providing children with firsthand experience in earning, saving, and spending money increases the likelihood that they’ll develop the framework necessary to manage their personal finances as adults, says Marguerita Cheng, CEO of Blue Ocean Global Wealth.

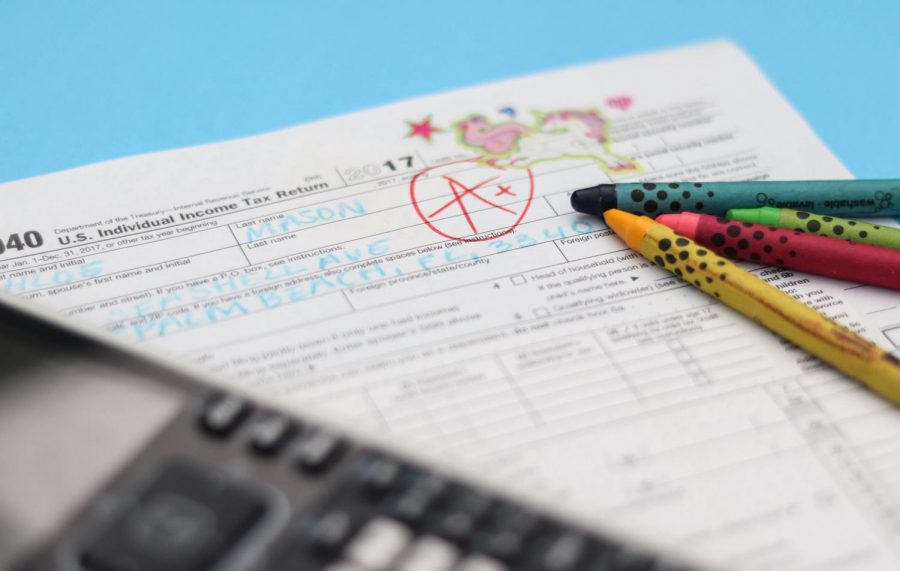

Helping Children Become Financially Literate - Resources for Children and Parents With job loss, market uncertainty, reduced income, and other financial issues caused by COVID-19, this article was designed to help parents and educators teach financial literacy to children, teens, and people with developmental or learning disabilities, while providing a number of fintech-related resources to help simplify the process. Today’s economic uncertainty has brought the need for financial literacy to the forefront, as 75 percent of Americans say they have taken steps to adjust their personal finances. Furthermore, a national study by the Federal Deposit Insurance Corporation (FDIC) showed similar findings for teachers, revealing that less than 20 percent feel competent enough to teach financial literacy topics in the classroom. While most parents today feel it’s their responsibility to teach their children financial literacy, most have not been successful at it. Money management is a critical life skill - and one that should be taught like any other key skill or competency - and COVID-19 is an important reminder that younger generations should be equipped with financial literacy knowledge before they experience an unexpected event. Research conducted by the Federal Reserve Bank shows that households with children are among the most vulnerable to an income shock, such as economic hardship caused by the COVID-19 pandemic. If you’re worried about money, you’re not alone according to the American Psychological Association (APA), 72 percent of adults report feeling stressed about money. When sudden events occur, it may not always be immediately apparent that you are heading toward financial hardship. They can arise as a result of a pandemic, family illness, job loss, urgent home repairs, weather events, and more. Financial Literacy Guide for Children: 20+ Resources to Introduce Money Managementįinancial emergencies can happen to anyone at any time.

0 kommentar(er)

0 kommentar(er)